It’s not like Tiger Global has been out of the news for the past 2ish years but there seemed to be a chatter slowdown after the news cycle of their public portfolio being down bad. They are just like us and our Robinhood accounts. Same names, bigger dollars. And a whole lot richer! Im joking, mostly.

I think they are bubbling up in conversations again after Eric Newcomer published some intel on how its competitors Coatue and ICONIQ are doing.

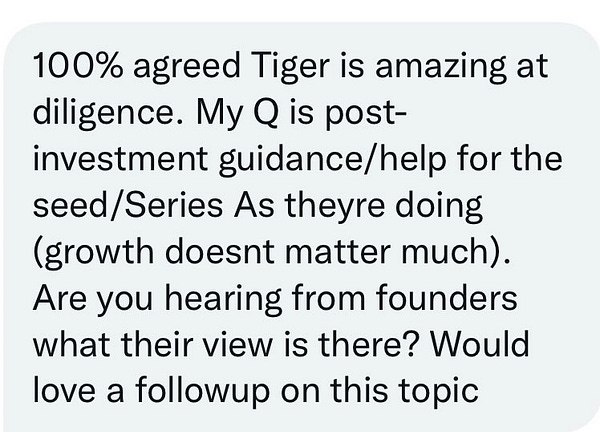

I crowdsourced feedback on Tiger back in November of last year from a bunch of founders and investors. That was literally the peak of the market! It all went downhill from there. That thread turned out to be a very positive one. Some even accused me of being a shill. I really have no horse in the race.

Anyways, we are halfway through this shitty year now. It felt like the right time to go back to some of the people I spoke to and ask if and how their views are evolving.

Along with the description of the person, Im sharing below their past and current perspective. Every single person here is well connected and credible. Most investors make self serving arguments when you talk to them about Tiger but this bunch is refreshingly honest and why I went back to them.

GP at well known multi-stage firm

Then :

Now :

Me : Has your thinking evolved?

“Hasn’t greatly changed except my opinon on them going down market and the success there. Tiger was offering beta (private market index) to investors so they get the ups and down. It’s been documented that something like 1/3 of the alpha in hedge funds is just greater inflows to the asset class (more money comes in more of the same names get back and it’s a cycle). Privates aren’t that different so index funds benefit greatly from inflows. I’m skeptical many great companies will want their money at series A but counter to that is they coled sentintel one at series A, peloton, etc and I think they have just as many $1b positions from leading series A’s as growth. But that was also Lee vs John or Alex. Where tiger gets themselves in trouble (and same as lots of firms) they put significant portions of total capital ever raised into the market at the top. Most hedge funds destroy more value then they create because of this dynamic and they are kinda falling into same trap. Does a private market index work? Still probably but for later stage. Did their quality bar drop at some point, for sure. Did they get greedy off fees and AUM chasing, hard to tell for sure but would guess that is a large part. All investment strategies have a capacity limit and that may have been forgotten in past two years. They have a different cost of capital then most VC firms. But there are firms that have a cost of capital advantage over tiger, some incumbent private equity, SWF funds. I started to hear some deals get underwritten to 8% IRR at late stages. Now this is all being long winded but I think that’s the hardest point to comprehend is all firms have smart people but firms play different games, from venture to cross over to public/SWF. I also think where tiger made bigger missteps is prob on public side. So much of their team was split in public and privates to the point where I don’t think their public book was actively managed and just had way to many names. It’s actually hard to do both full time because public markets is an always on job while privates require you to meet founders fly around and just be away from the public markets.”

Me : Do you see any of your companies coming back and saying they regret taking their money and not having a board member?

“As much as I would want to say yes I think most knew what they were getting. Some may regret the price they optimized for but that isn’t a tiger specific thing. For most tiger TS’s it wasn’t really the choice of no governance, no board and high tiger price vs. board seat, modest price VC termsheet. Most growth rounds don’t come with board seats generally so find that a bit overblown. Series A/B was a bit more novel to take it. Tiger wasn’t n of 1 product just the most aggressive or had largest economics of scale.Many tiger companies have prior board members. So there is a bit of freeloading they benefit from. But also 90% of board members are prob not useful. Lots of VC’s do it for status rather than any really governance reason or fiduciary duty. Young investors are told they need board seats to be promoted and to be a ‘trusted partner’ to move up a in a firm. Creates a pretty negative board dynamic at lots of companies imo. And case in point is just look at how some investors show their LinkedIn or twitter bios and which boards appear where (and even better how they change in time). Lots of status seeking.”

Me : Thoughts on this?

“Its def happened. Not sure what is going on my guess is managing liquidity and fund runway. I think they wanted to raise a fund quicker and realize LP's are prob pushing back.

and also think so many venture funds have told LP's building an index at seed/Series A is much harder because of adverse selection so not sure if LP's love that product as much

but last comment is just a guess

i do find alot of VC's like to point fingers at tiger and say I told you so but a16z didn't play that different of a game esp on crypto side. Same with Insight and GC. Altimeter was probably more top of market and made fewer but bigger mistakes. D1 same, they may not have been as crazy but I think they built a lower quality portfolio.”

GP at well known crypto firm

Then :

Now :

Me : Has your opinion evolved?

“Not really. They are notably absent during this time when companies need real help.”

Me : Can that not be said about most venture firms? I constantly hear from founders how their lead firms are not doing the one thing they need : Financing at good terms to get through this period

“Well depends on the situation. That could be like a child complaining about not getting enough ice cream? We can all have unrealistic wants.

I think the harder thing is to "dig in" and understand what is realistic in this market and navigate the various potential outcomes.”

Me : lol fair! Do you see a shift in how founders think of the product they offer? Are VC firms stuck in a love hate relationship with Tiger?

“Not sure tbh.

I’ve seen a few blog posts from VCs proclaiming the end of capital like Tiger’s which reads a little optimistic / self serving in this moment.”

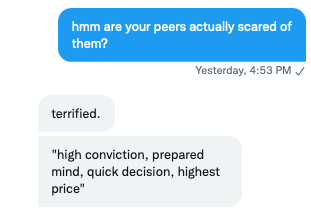

GP at well known seed firm

Then :

Now :

“lot of schafenfreude for tiger in particular

(which is interesting since, say, insight is also crazy active)

coatue ppl seem to respect (easy to be respectable when you’re sticking in cash for the rest of the year)

D1 similar schadenfreude

as for whether ppl are afraid of them: not at the moment, no! they are stuck between hoping what happens to tiger global is what happened to tiger management

and hoping tiger comes back to keep their marks flowing

so there’s a lot of watching and waiting”

Me : Interesting! do you sense their portfolio founders regretting not having board members after raising A from them?

“imho, no

not in my opinion — in my experience

ppl were happy for the money, and those who raised enough where glad they had enough $$ to ride it out”

Me : Many traditionalists are counting on that vibe shift!

“indeed. bigtime counting on it

it’s a safe thing to expect since capital is scarce

but we shall see. founders *really really* liked having more control and less dilution.”

Me : yeah makes sense....do you think they will come back with a bang soon?

“man. above my paygrade

not impossible to imagine tiger not making it this year

if there is more to the downside because of earnings compressions from reduced demand

then down bad could go to being down and out…

so who tf knows

BUT i do think venture cat is out of the bag

every allocator on earth is trying to figure out when to re-enter venture (if they have pulled back)

so long term, awno man. maybe still an interesting story”

Me : Aren't most elite ones already in given the massive AUM raises of q1?

“1. depends on how bad it gets (LPAs have been renegotiated in prior crashes…)

2. depends on if there are any big failures among investment managers

this next year could be very quiet and very rough.

but long term,

this is still the greatest show on earth”

Me : Thoughts on this?

“live by the sword, die by the sword

they are long (and sometimes) short hedge fund!

and a hedge fund born from the ashes of a dotcom blowup no less

so, not that surprising… again — tiger themselves may not make it

the phenomenon, though, may carry right on.”

A prominent solo capitalist

Then :

Now :

Me : Any evolved view on Tiger?

“amazing timing until it wasn’t

i think the idea is fundamentally correct still

and that they probably shouldn’t retreat as hard as they seem to be. going into seed’s/A’s doesnt make much sense to me

but being an enterprise saas index fund seems great, they just need to be paying 110% of the market always, not like, 300%”

Me : What's fundamentally correct? That founders loved the product (no board, large round, high valuation, little dilution, high speed)?

“That funding should be more programmatic for certain business types

Which allows a lot more capital to enter the ecosystem, driving returns down, but ideally delivering a more predictable return/risk profile.”

Me : How are your founder friends that took their money feeling these days?

“I don’t think there are any particularly interesting anecdotes that aren’t inseperable from the market broadl

ie wishing Tiger would step up to fund them now but that’s not a feeling others don’t have that have other investors.

I don’t know anyone that’s unhappy honestly

that said, impossible for people to test the counterfactual, and i think most people would’ve been happier taking lower offers from folks that would have done more work for them (or pushed them)

while overplayed and has become a meme, i do think there is a role for the investor or board member to push the extremes (ie be more bearish right now, push to lower expenses more, push to fire more, etc)”

Me : Yea that's interesting and its being used as an argument by traditionalists

“i’m generally quite skeptical of that view, but i’ve only come to believe more and more that it’s really important to have folks outside of your business that have deep context to give feedback and push”

I will likely do a second installment and share more chats soon! DM me on twitter or reach out at sarthakharibhakti@gmail.com if you have intel to share!